Accounting Firm Sacramento

With the right skills, experience, commitment and knowledge, a bookkeeper can make a terrific addition to any organization. Digital bookkeeping services are the means of the future and also also a straight worker that operates in your office must have the capacity to do almost every element of the work online if the right systems are set up. Outsourcing bookkeeping solutions for local business is now preferred by several since doing manual purchases makes the job very tiresome. Also, in this age of computerization, the transactions done by a person stay private and safe and secure if they are carried out online. The consultation process will help us get an understanding of you and your business.

You require to ensure that you employ a respectable company that can execute all the audit tasks that you require done. The audit as well as bookkeeping services that you involve are different from each various other. You should recognize the difference between accountancy and accounting to ensure that bookkeeping sacramento you would not get perplexed when your accountancy documents show something that is not remedy. You also require to check the records routinely to make sure that you can be able to take care of whatever is wrong. In order to do that, it is really crucial that you understand how they are various.

Digital Accessibility, opens new tab

This means you’ll always have up-to-date financials at your fingertips, whether you’re in Old Sacramento or out in Natomas. We help you navigate California’s complex sales and use tax, and we are well-versed in the state’s specific laws regarding franchise taxes and income taxes for businesses. With Bench, you can focus on what you do best—running your Sacramento business—while we manage the financial details. Addfi Tax is bookkeeping services provider that caters to commercial establishments in Sacramento. Its services include comprehensive payroll management, tax preparation, tax relief, issue mitigation, audits, and new business formation. Clients with IRS issues can also seek the company’s assistance in non-filing, back taxes, IRS seizures, bank levies, and wage garnishment.

The accounting software application utilized for this procedure is accounting and also accounting solutions for small business owners. It can be accessed through the internet and also it is usually free to use. This software application is used by the contracting out company to preserve the balance sheet of the client company. Because it is readily available online, all the audit and also bookkeeping solutions for local business proprietors can be contracted out with internet and the firm can concentrate on its core organization. Contracting out accounting services can provide many benefits to businesses of all sizes and across any market. One of the main factors businesses outsource accounting services is cost savings.

Juan Reyes, CPA – Books To Scale

Aside from having to pay an additional year of tuition, many students traditionally wait until they graduate before they work full-time at an accounting firm. As a result, there is a substantial opportunity cost to the 150-hour requirement. https://www.bookstime.com/ There have been constant challenges to attracting talented individuals into the accounting profession; therefore, does it make sense to continue to require an additional 30 credits of education to earn the CPA license?

- In addition, accountants are responsible for ensuring that all necessary files are kept on file for future reference.

- Crowe horwath is very knowledgeable on the many tax laws and how the differ from state to state.”

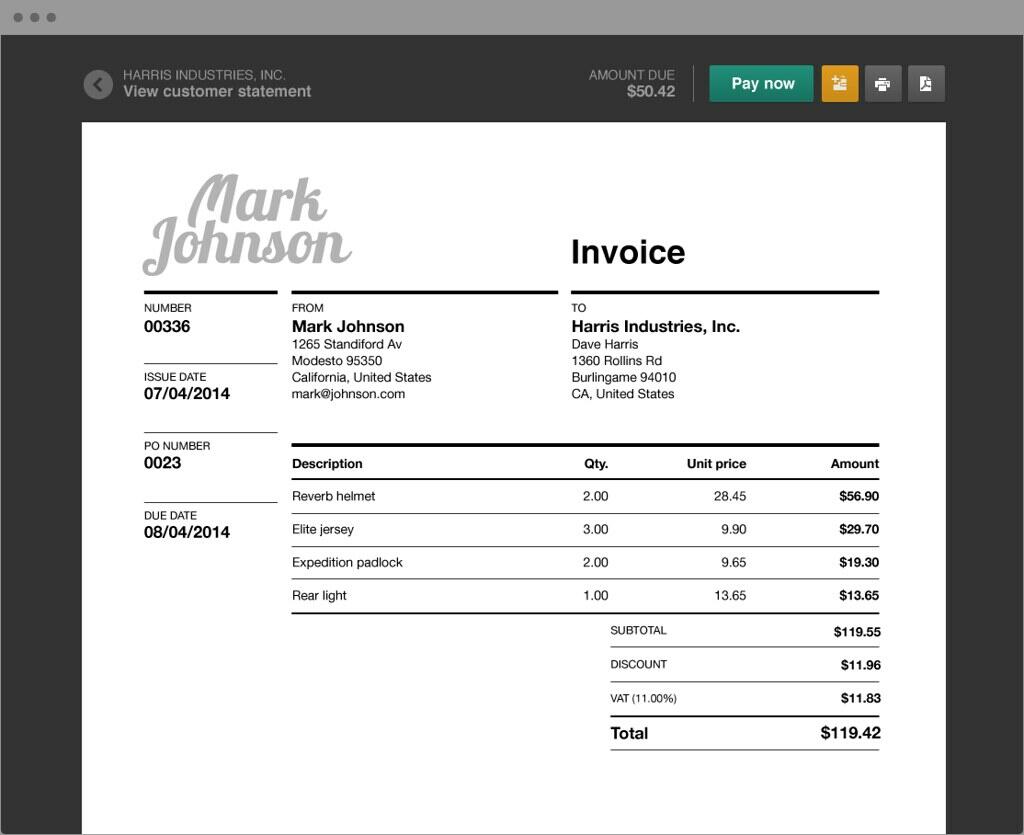

- Clients can easily convert their companies to paperless billing and cash flow solutions that maximize profit and streamline efficiency.

- The time and effort are dedicated to enhancing quality and proficiency in the market.

- Based in Sacramento, Packey Law Corporation is a tax law firm specializing in resolution, preparation, bookkeeping, business consultation, and audits from the IRS and other entities.